Loyalty Design

Build programs effectively for your business and customers. With new entrants in the loyalty space and plenty of exciting ways to build programs with new digital features, it can be tough to decide where to start - and what customers actually want.

How program design decisions get made

The first principles of loyalty design:

Ease of use

- One of the top reasons (56%) members prefer one loyalty program over another is because it is easy to use.

- Offers rewards that are relevant to me ranks second at 50%.

- Program is trustworthy comes in third at 43%.

Real-time experiences

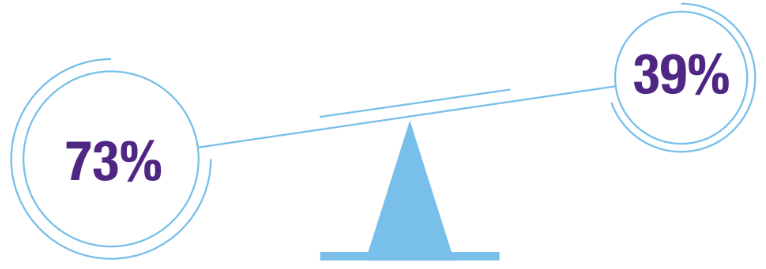

- Our research shows that program members want to see their account activity in real-time – specifically, 73% want to see instant currency updates and redemption information.

- Yet, only 39% of operators believe their program is differentiated by providing customers with a real-time experience.

We asked Tad:

Should operators strive to deliver real-time?

The advent of technical improvements to deliver real-time messaging, offers and redemption across multiple customer contact points is proving to be highly successful in driving revenue growth and increased customer engagement.

Tad Fordyce

SVP Loyalty, EpsilonWhat program models do members prefer?

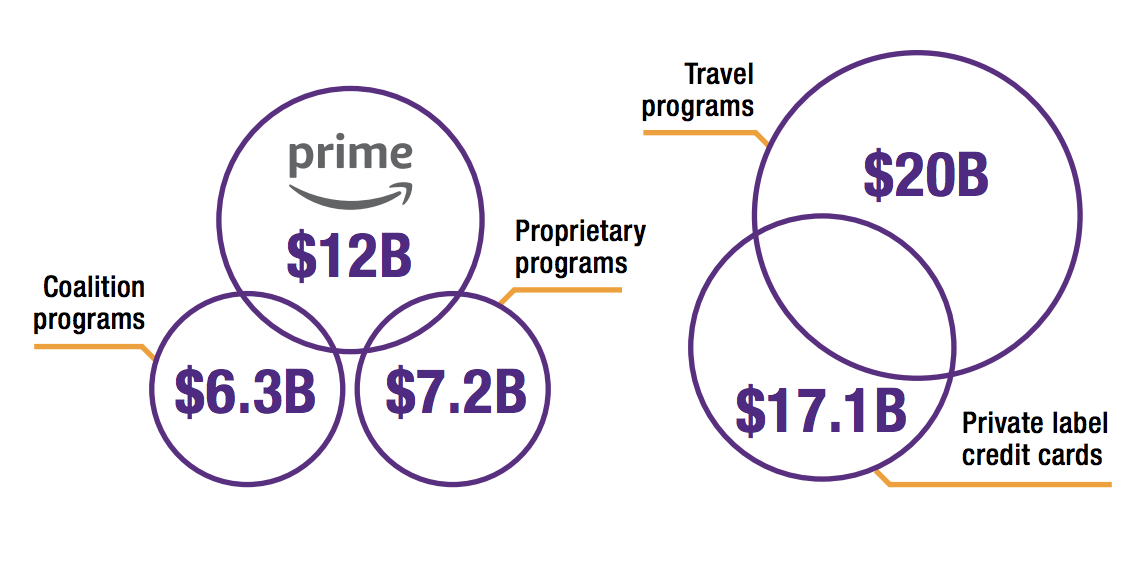

Proprietary programs are “all about me” in the sense that they issue their own currency or discounts to their own customers and rewards are redeemed on their network. Programs like Starbucks Rewards, Safeway’s Just4U and Sephora’s Beauty Insider have a huge following, but there’s another growth story in multi-partner programs.

Coalitions and frequent flyer programs (where many companies use a single reward currency), payment co-brands and arguably, Amazon Prime and Alibaba’s 88 VIP, serve the needs of multiple partners by rewarding consolidated spend within a network. For the customer, this means earning a reward faster and enjoying more diverse reward options. For the company, it means more access to customers and more data.

Program model sizing comparison ($USD)

- Private label credit cards ($17.1B)

- Amazon Prime ($12B)

- Travel programs ($20B)

- Proprietary programs ($7.2B)

- Coalition programs ($6.3B)

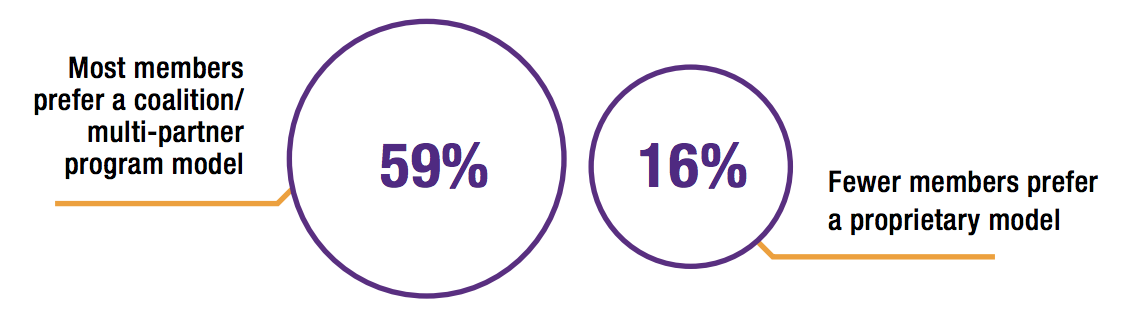

Member preferences

- Most members prefer a coalition/multi-partner program model (59%)

- Fewer members prefer a proprietary model (16%)

Operators perceived benefits of:

Proprietary program models

- (32%) Offers full control over program implementation

- (31%) Enables full ownership of customer data

- (29%) Offers full control of your brand /

Focused on specific industry /

Offers full control over program marketing and operations /

Offers full control on frequency or nature of communications to members - (28%) Offers consistent program experience across locations

Coalition program models

- (37%) Cross-promotions/partnerships

- (35%) Better return on investment /

More affordable than proprietary programs /

Access to more consumer data - (34%) The opportunity to leverage brand associations /

Cost to manage and market the program is shared across multiple parties /

The ability to join an established program - (33%) Access to partners’ customer bases /

More affordable to implement than a proprietary program

Hot Topic: Multi-motivator program models

Different customer segments respond to different stimuli and engage at different points in the shopping journey. To avoid treating customers with a one-size-fits-all approach, many companies are moving to multi-motivator models, which essentially means operating multiple loyalty motivators at the same time.

- In grocery, points, digital targeting and promotional programs are running concurrently to appeal to different shopper segments.

- Travel programs for airlines and hotels layer points, credit card benefits, booking discounts and upgrades into their program tiers.

- Other consumer-facing companies who have a lot of data (like Turkcell, an award-winning telco in Turkey), are running individualized loyalty programs that are different for each distinct customer segment in their portfolio.

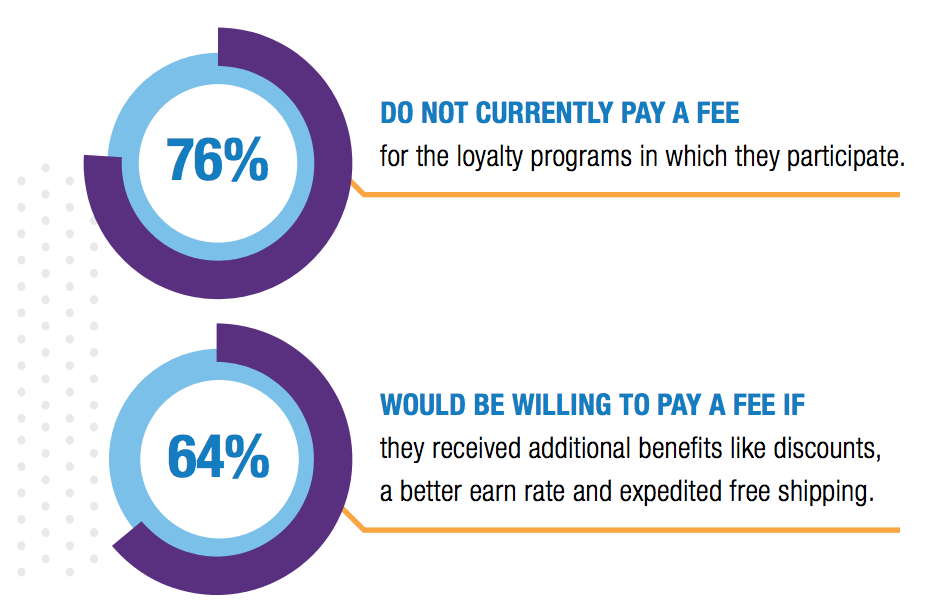

Hot Topic: Fee vs. free program feature

There is misalignment between practitioners who would be interested in considering adding a fee component to their program and the low rate of their existing members who would be likely to pay. Paid programs are not for everyone. Operators need to use the data tools at hand to find alignment between what members want and need, and how their program can address those member needs.

76% DO NOT CURRENTLY PAY A FEE for the loyalty programs in which they participate. 64% WOULD BE WILLING TO PAY A FEE IF they received additional benefits like discounts, a better earn rate and expedited free shipping.

Loyalty Design: Summary

Overall, our research shows companies are still more competitor-centric than customer-centric, despite the fact that customer preference data is well-reported, and both diagnostic and predictive data are now readily available.

On a positive note, companies are recognizing that not all customers are created equal. Many are adopting a portfolio approach by layering a paid program or private label credit card for best customers, a free program for less engaged customers and promotional reward programs for other segments. The challenge is to measure results to ensure that program operators understand which drivers are delivering incremental spend and visits.

We asked Tad and Shannon:

What can retailers do to cater to different customer preferences?

Many retailers are also increasing spend to evolve email “club” programs to more formal, data-driven loyalty or CRM programs resulting in more customer participation.

Tad Fordyce

SVP Loyalty, EpsilonWe’ve seen that customers who have a branded credit card show increased loyalty and spend more — an average of 55% of branded credit card sales are incremental to the brand. But our research also shows that loyalty for today’s consumers is complex and exists on a continuum, as they look for brands to meet their needs ranging from the functional to the emotional. Brands that understand their place on this loyalty continuum will be most successful at engaging their best customers and earning their loyalty.

Shannon Andrick

Vice President Marketing Advancement, Alliance Data