Customer Management

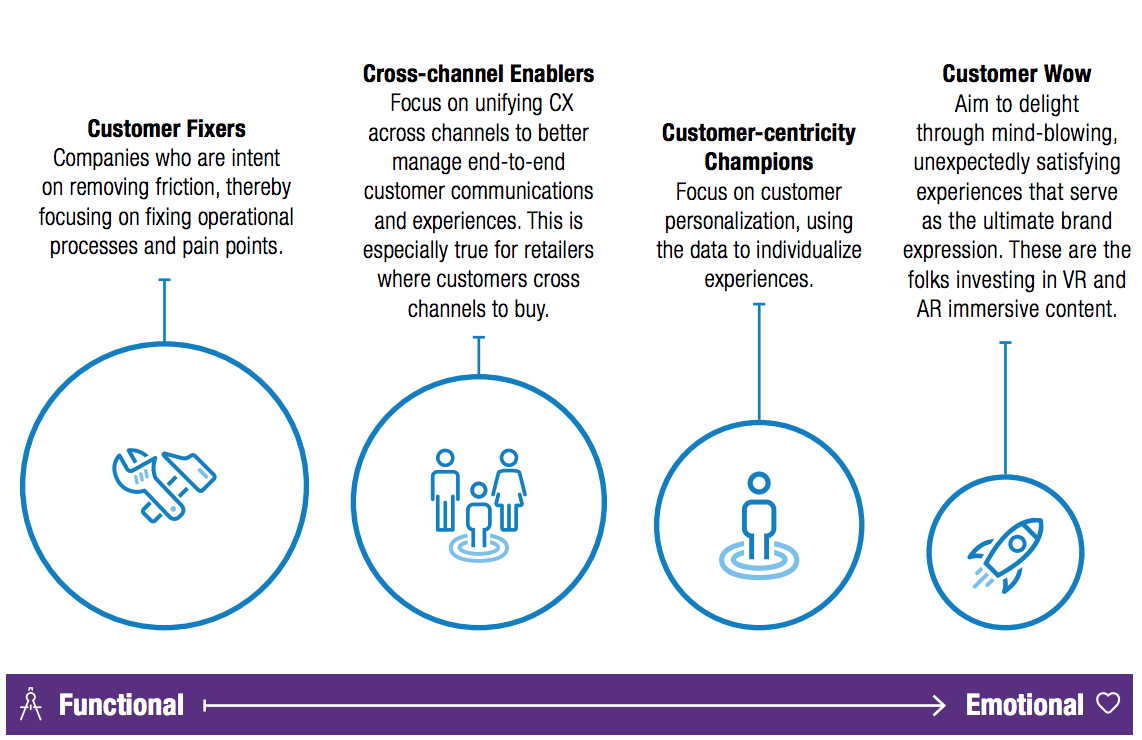

How important is customer experience for loyalty program investment decisions? A recent Forrester report6 states that 94% of retailers agree their firm is customer-obsessed, but only 9% actually are. First, let’s be honest – everyone defines customer experience differently. Based on a 2017 LoyaltyOne retail study,7 we identified four differing company mindsets on customer experience:

Where does your company sit? Is it right for your customers?

- Customer Fixers Companies who are intent on removing friction, thereby focusing on fixing operational processes and pain points.

- Cross-channel Enablers Focus on unifying CX across channels to better manage end-to-end customer communications and experiences. This is especially true for retailers where customers cross channels to buy.

- Customer-centricity Champions Focus on customer personalization, using the data to individualize experiences.

- Customer Wow Aim to delight through mind-blowing, unexpectedly satisfying experiences that serve as the ultimate brand expression. These are the folks investing in VR and AR immersive content.

Not every company can afford to treat their customers to a perfect experience – but it’s important to note the direct link between company margin and customer experience funding. In categories like luxury goods, the high margins and customer spend allow for more investment in customer experiences for things like personalized services. In a lower spend category like grocery, retailers need to be more creative to delight customers while driving sales. Take Walmart, for example. The retail giant provides a no-frills and dependable in-store customer experience that customers value. They don’t promise to satisfy all customer wants, but they deliver on their promise of low prices and consistent service.

We asked Bruce:

How can retailers amplify their customer experience without breaking the bank?

These days, retailers have to think outside the box to elevate their customer experience in a cost-efficient manner. Reviving the concept of in-store theatre as a compelling motivator to complement loyalty program investments may be just the kind of differentiator that brick-and-mortar retailers need to consider. As for cost-efficient, many retailers have enjoyed lasting results by delivering in-store takeovers as part of their promotional cycle. Partnering with other wow experience brands is another successful result-amplifying approach.

Bruce Kerr

SVP and Chairman, BrandLoyalty North AmericaDigital: Minimum entry requirement

Many companies today are rushing to adapt their business models for the digital world, driven by e- commerce, app adoption, Facebook and of course, Amazon and Alibaba. In fact, 79% of top loyalty programs globally have a digital component. Digitizing customer interactions and experiences and adapting people, process and products to today’s digital landscape is no easy feat – while also taking into consideration that there are existing customers who prefer to use a physical card. Digital adoption requires serious tech investment, change management and transformative thinking to break down silos and legacy processes.

79% of top loyalty programs globally have a digital component.

We asked Chris:

Can you see costs coming down anytime soon?

Digital is now the front door of almost every commercial experience, meaning the operating cost to create a ‘loyalty’ interaction is even higher. This likely means even more companies will soon up their efforts.

Chris Walton

Former VP, Target Store of the FutureSimply having a digital presence doesn’t set programs apart

Digital loyalty seems easy enough. Register your customers, invite them to download the app and you’re set and done. Or not. We asked program operators and program members about the world of digital relating to loyalty:

Only 18% of members say digital experience plays a role in program preference.

Program operator feedback:

- 70% of practitioners say members interact with their program via a website, followed closely by a physical card.

- 69% of programs still offer a physical card. 31% of programs are digital only.

- Most common challenge faced by operators with digital apps: Keeping tech up-to-date (62%).

Member feedback:

- Only 18% of members say digital experience plays a role in program preference.

- On a regional basis, 78% of members in Canada prefer to use a physical loyalty card. Use of a physical card is significantly lower in Singapore, where only 55% still use cards.

- What tops the list for members? Programs that are easy to use (56%) and offer relevant rewards (50%).

Channel preference by demographic:

- When we look at channel preference for collecting program currency, 45% of 18-34-year-olds and 35% of 35-54-year-olds prefer using a mobile app, whereas only 16% of 55+ year-olds state the same.

- 65% of members aged 55+ prefer using a physical card when collecting program currency.

Question 3

What is the age of your primary program member demographic?

You chose:

Store and real-estate planning

Our clients have seen a 1-4% increase in sales when they leveraged their loyalty data across pricing, promotions, assortment, and marketing.

Customer Management: Summary

Customer experience can be the forever quest and elusive goal. You’re fixing problems and removing friction while digital disruptors are re-inventing the experience itself! Take stock of how much investment you can allocate to customer experience and concurrently evaluate investment allocation to both fix customer problems and create wow experiences. Both are needed to compete right now.

Having a digital loyalty presence is just good business – customers simply expect seamless online experiences and easy cross-channel navigation. To truly provide an exceptional customer experience, think about how to make your customers happier in a way that suits and reflects your brand promise (and don’t fuss over trying to fix all customer pain points at once).

We asked Aaron:

How is digital impacting retail competition?

Retailers have long held consumer packaged goods (CPG) and original equipment manufacturers (OEM) at bay from consumers by controlling access to customers via the sliding glass doors of their stores. But now common-day, multi-use technology, such as our smartphone, is enabling CPGs and OEMs to have material, direct connections with consumers. This is shifting retailers to better manage their merchandising relationships. Now they must also consider the influence and impact these brand-led relationships have on their own customer relationships.

Aaron Dauphinee

Chief Operating Officer, Wise Marketer Group